What is a Trusted Contact?

Submitted by Clarus Wealth on April 26th, 2023Learn how a trusted contact can help your financial firm help you, if needed. Contact us for more information.

Learn how a trusted contact can help your financial firm help you, if needed. Contact us for more information.

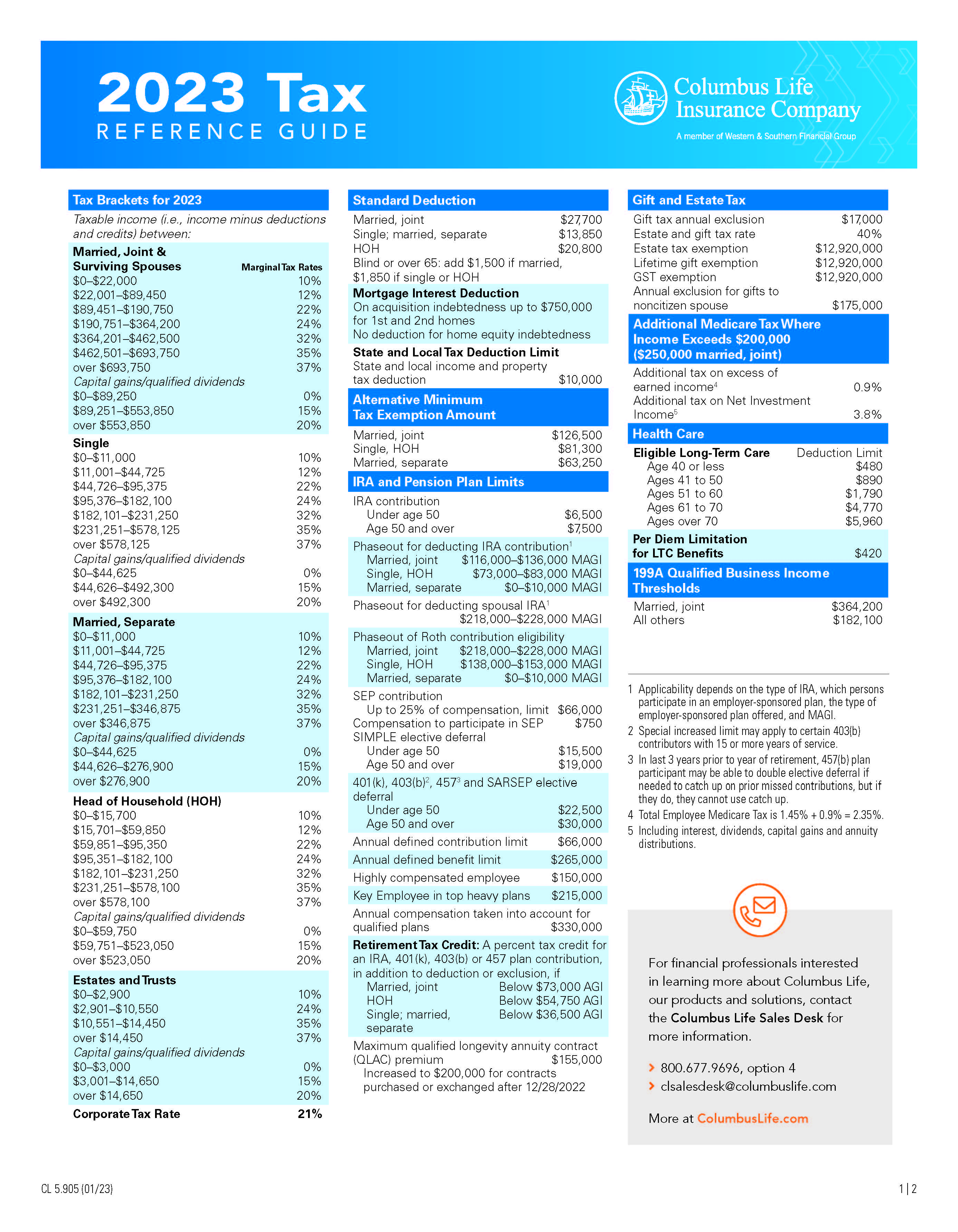

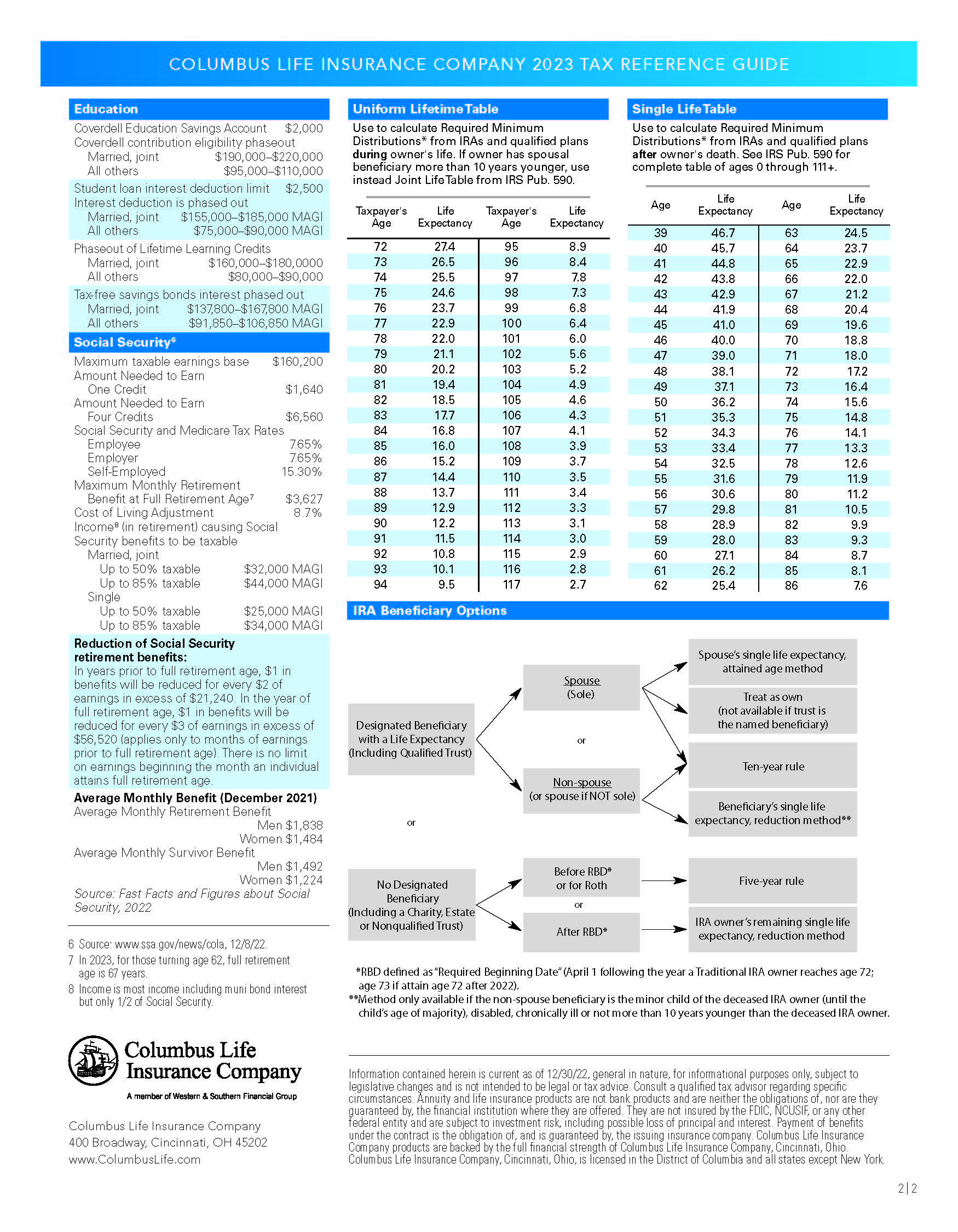

The 2023 Tax Reference Guide is now available, containing information regarding Tax Brackets, Gift Taxes, IRA Limits, and more.

Information regarding Tax Brackets, Standard Deductions, IRA Limits and more can be found in this 2022 Tax Reference Guide.

Funds held in 529 Plans can be used for more than just college tuition: Read about 10 Qualified 529 Expenses here.

Want to learn more? Click to contact us.

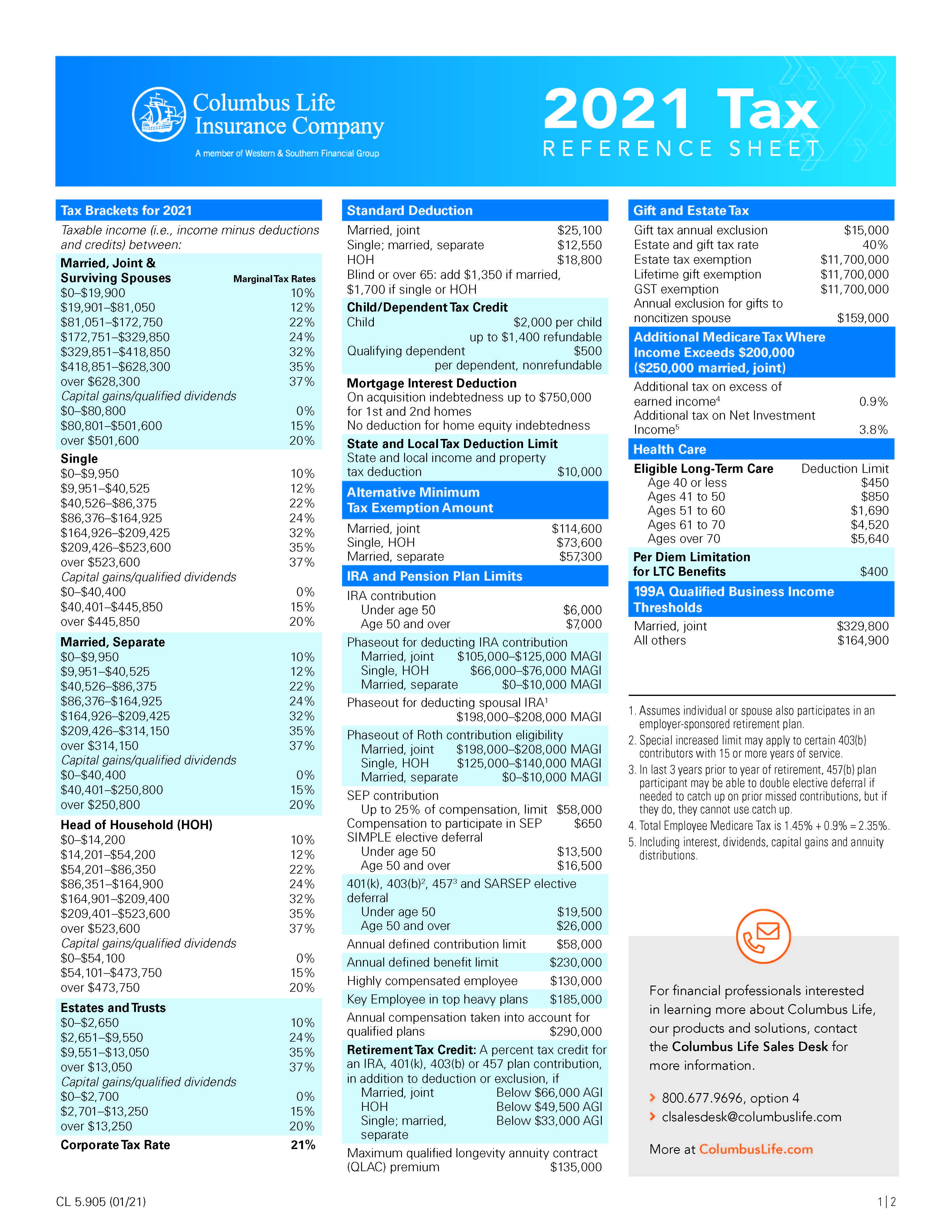

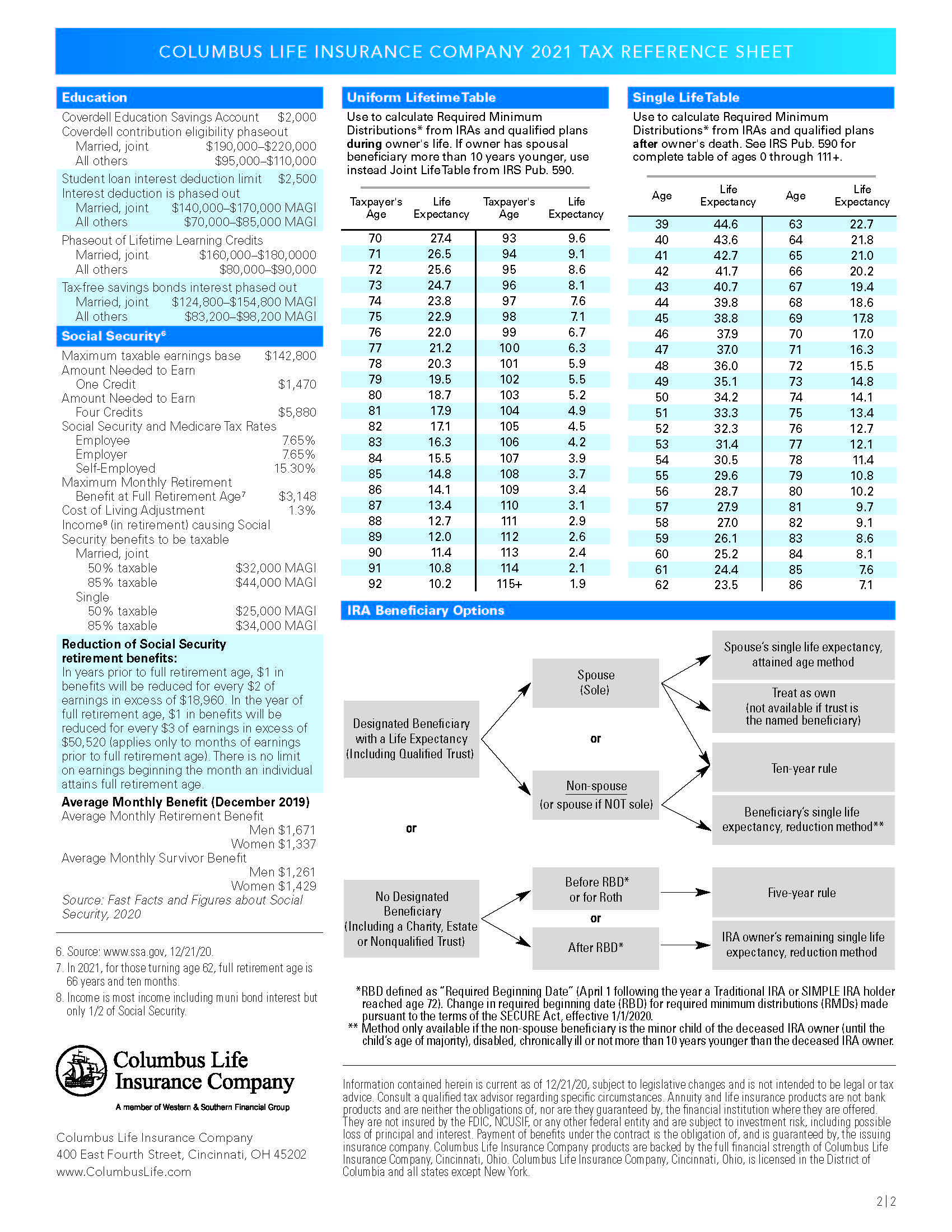

Taxes can often feel overwhelming so we're providing a helpful Tax Reference Guide for 2021, showing you important information in one place.

Mental health can impact Financial Health. This article discusses how they're linked, and some ideas for improving your overall wellness.

529 plans can help reduce tax liability and pass wealth to future generations, while still allowing you to maintain control of the assets - get the details here.

Contact us to find out how a 529 plan may fit into your estate plan.

For more information about any 529 college savings plan, contact us for more information at (720) 510-1199 to learn more about investment objectives, risks, charges, and expenses. Consider the investment information carefully. All investing is subject to risk, including the possible loss of the money you invest.

Contribution limits to Health Savings Accounts are set to increase for 2021. This article contains additional information.

Do you have (or know) a child attending or preparing to attend Higher Education? Click here to read about applying for Financial Aid - including whether or not a 529 Plan excludes a child from receiving aid money.

The CARES Act was designed to “provide emergency assistance and health care response for individuals, families, and businesses affected by the 2020 coronavirus pandemic.” Click here to read a brief overview of some pieces of the CARES Act that may be of interest to small business owners.